Last month, the Federal Open Market Committee (FOMC) surprised no one by cutting interest rates for the first time in four years. What may have surprised some was the magnitude of this cut. The FOMC bucked its ongoing trend of a 25 basis-point move to a more substantial 50 basis-point move, which was agreed upon by all but one of the 12 voting members.

Since most institutions have been expecting lower rates for quite some time, your credit union’s investment planning has likely already begun. However, for many credit unions, it’s been a while since your last investment activity. If your credit union falls into this second category, it might be time to consider four investment planning/strategy tips, which I’ll share later in this article. For now, let’s look at what’s happened since the rate cut in September.

Why was the rate cut more aggressive this time?

Crucial inflation numbers released prior to the FOMC meeting showed the Consumer Price Index (CPI) dropped to 2.5% in August while the Producer Price Index (PPI) lowered to 1.7%, which was down from an increase of 2.1% the previous month). These decreases gave Fed members enough ammunition to move faster and perhaps help improve the signs of a weaker labor market.

What has been the net effect of this “jumbo cut?”

Overall, the markets liked the larger-than-expected hike. Though the Fed hasn’t publicly grabbed the flag to do the victory lap, the most recent economic data has pointed to a soft landing for the overall economy. The Fed likely won’t have to be as aggressive as some thought this past summer regarding future rate cuts. The following are the economic results in the weeks after the “jumbo cut:”

The September non-farm payroll (NFP) report, which represents the total number of paid workers in the U.S. (minus those employed by farms, the federal government, private households, and nonprofits), was much stronger than expected, and inflation continues to tick down.

Treasury rates have moved up since the nonfarm payroll number was released earlier in the month.

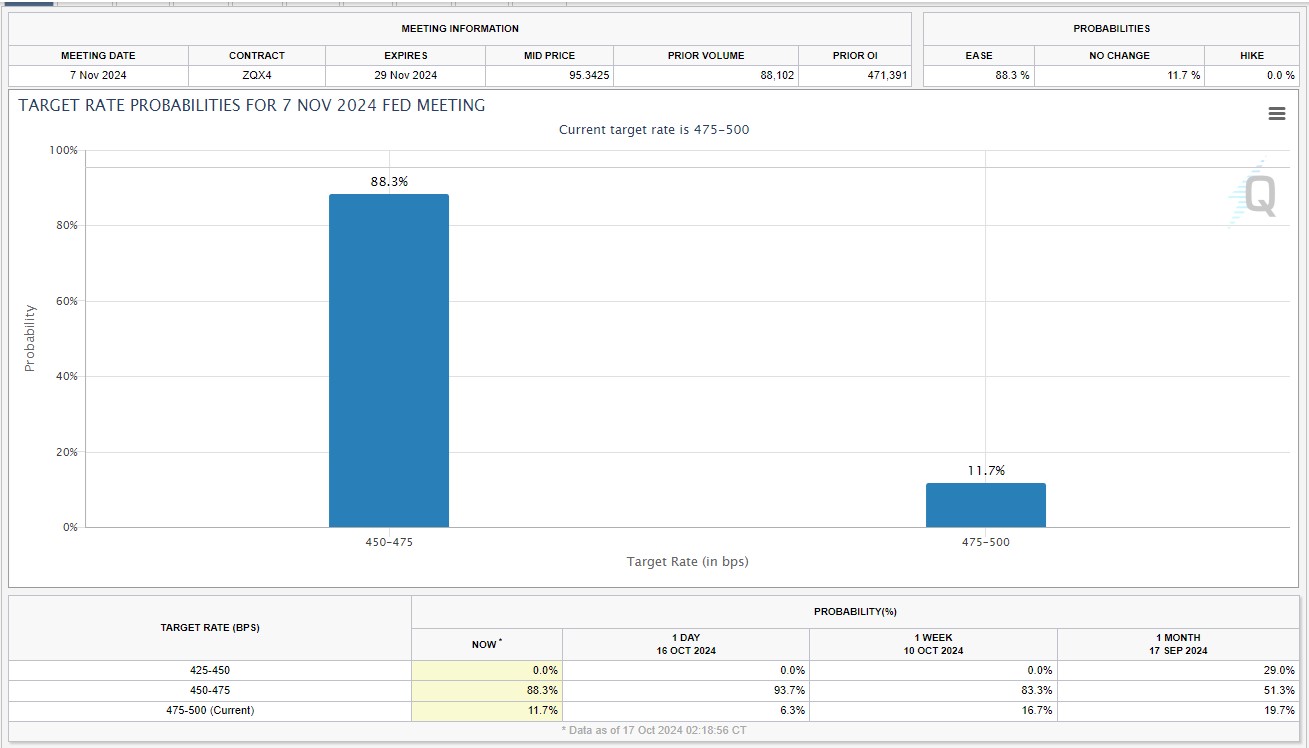

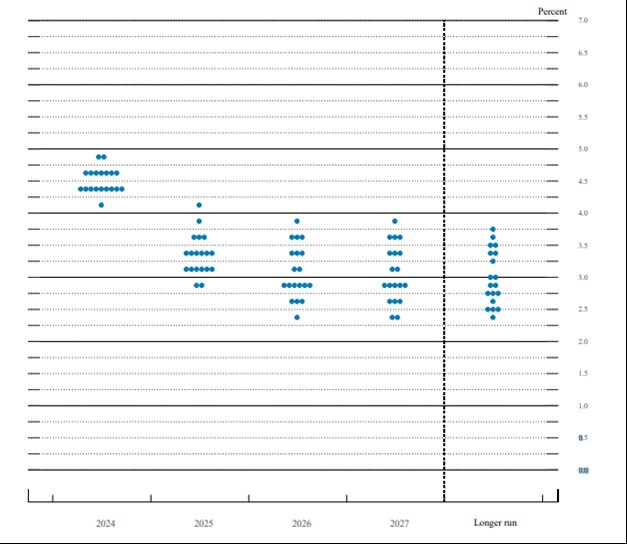

Bets on Fed Fund futures (first chart below), which change daily and include other dynamics, have adjusted downward. This less aggressive projection now matches the two additional cuts as shown in the Fed’s dot plot chart from September 2024 (second chart below).

Target rate probabilities for the November FOMC meeting. Source: www.cmegroup.com.

Target rate probabilities for the November FOMC meeting. Source: www.cmegroup.com.

Fed’s dot plot chart from September 2024

Fed’s dot plot chart from September 2024

Updated every three months after the FOMC’s meeting, the dot plot chart records each FOMC member’s projection for the target overnight funds rate based on a summary of economic projections. This chart from September shows two more projected 25 basis-point rate cuts this year, which would bring the target rate between 4.25-4.5%.

What have we been seeing from credit unions?

While we don’t know exactly where rates will be next year, the “normalization” of interest rates has begun. Credit unions making investments have been looking in the 3.5-year+ range to lock in higher yields. Some of the investment vehicles considered include the following:

Besides traditional certificates of deposit, U.S. Treasuries and Government agency bullets, mortgage-backed securities and CMOs also have value. The cash flows can be reinvested right now at higher cash rates. These investments have attractive yield pick-ups to other options.

Multi-family housing deals underwritten by the agencies are also popular. These bonds offer a similar profile to U.S. agency bullets with higher yields.

Limiting optionality in callable bonds is a good and popular strategy right now due to the falling interest rate environment, which means bonds have a higher likelihood of being called. The “normalization” of interest rates should continue to cause a steepening of the yield curve in the initial stages.

In addition, the quick rise in interest rates after the pandemic caused credit union investment portfolios to extend. This, coupled with solid loan demand and growth, made investments take a back seat to liquidity concerns. As pandemic purchases get closer to maturity, the need to reinvest those funds in investments will grow.

What should your credit union consider right now?

When running an investment portfolio that’s tied to your balance sheet, the most sensible strategy is a laddered approach closely tied to the tenors of your credit union’s liabilities (where possible), not the timing of the markets. However, as the Fed “normalizes” interest rates, now might be a good time for your credit union to “normalize” your investment portfolio. This starts with executing a plan, regardless of whether rates decrease by 100 basis points or 250. Consider the following four tips:

Begin diving deeper into specific security types and offerings. Compare offerings between providers. “Paper trading” never hurt anyone besides a few trees.

Review your credit union’s investment policy, discuss it with your ALM committee and board of directors, and make updates where needed.

Ramp up internal education to fill in knowledge gaps that might exist on different security types.

Review agreements, safekeeping, and those authorized to transact.

For more information about specific investment offerings and availability, I welcome you to reach out either to me or your senior investment services representative at 800/366-2677.

Meet your investment goals with solutions tailored to your credit union’s needs.